SignalPlus波动率专栏(20231103):市场回落,IV大跌

昨日(2 Nov)在市场对 FOMC 会议进行鸽派解读之后,十年期美债持续下行,创近三周新低,收于 4.66% ,两年期美债连日下破 5% ,收于 4.99% 。英国央行也连续第二次在会议上宣布暂停加息,全球债券市场收益率下跌,股市得到提振,欧洲股市连续第四天上涨,美三大股指也高开高走,道指/纳斯达克/标普分别收涨 1.7% /1.78% /1.89% 。

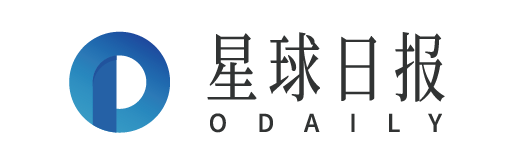

Source: SignalPlus , Economic Calendar

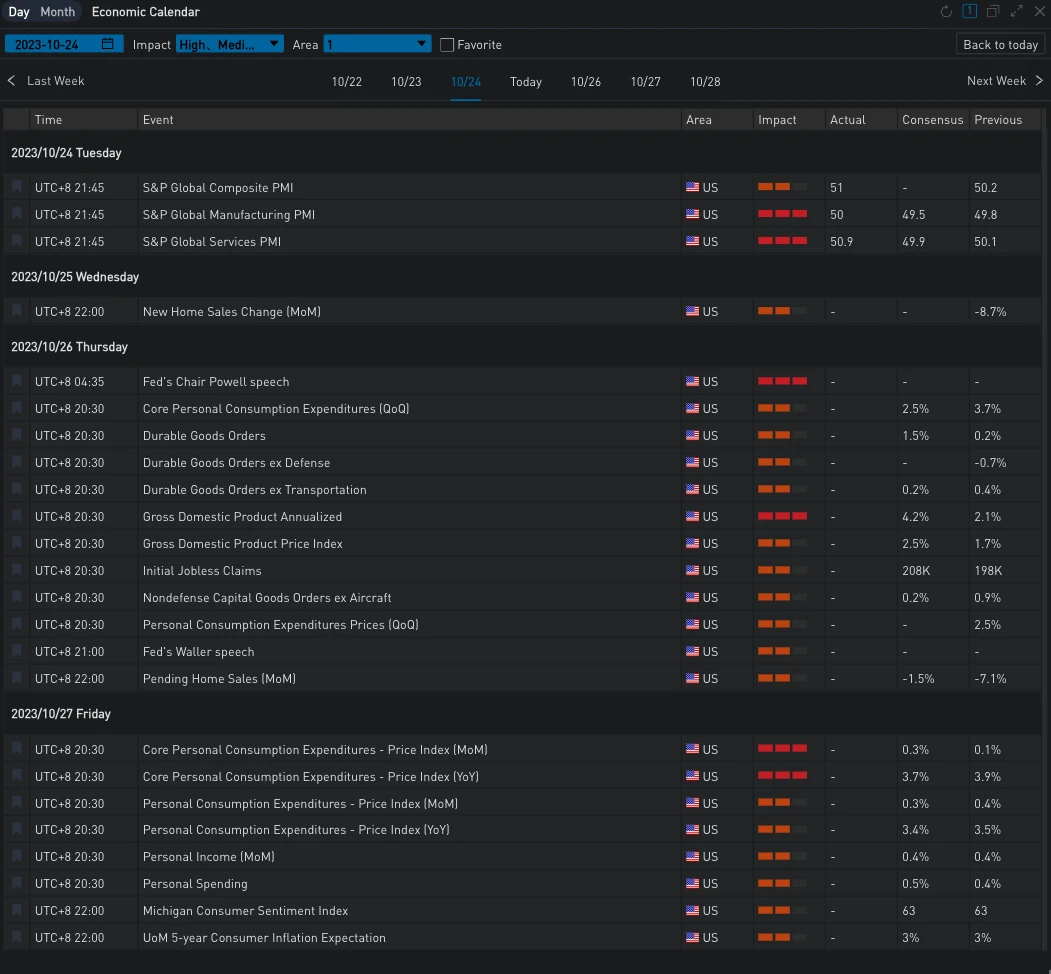

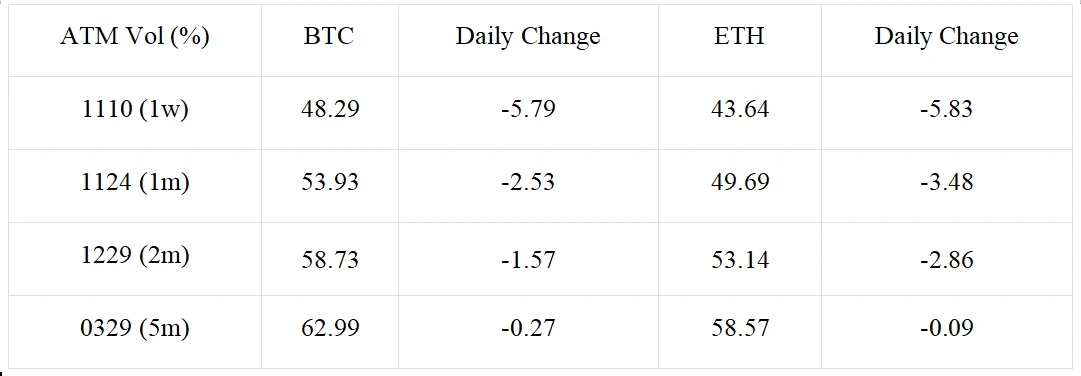

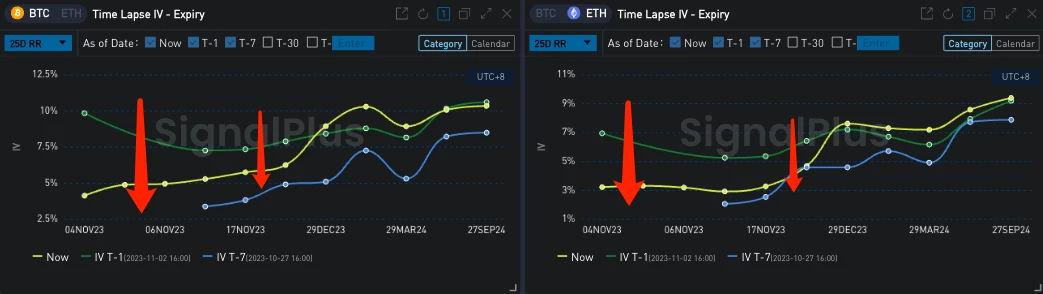

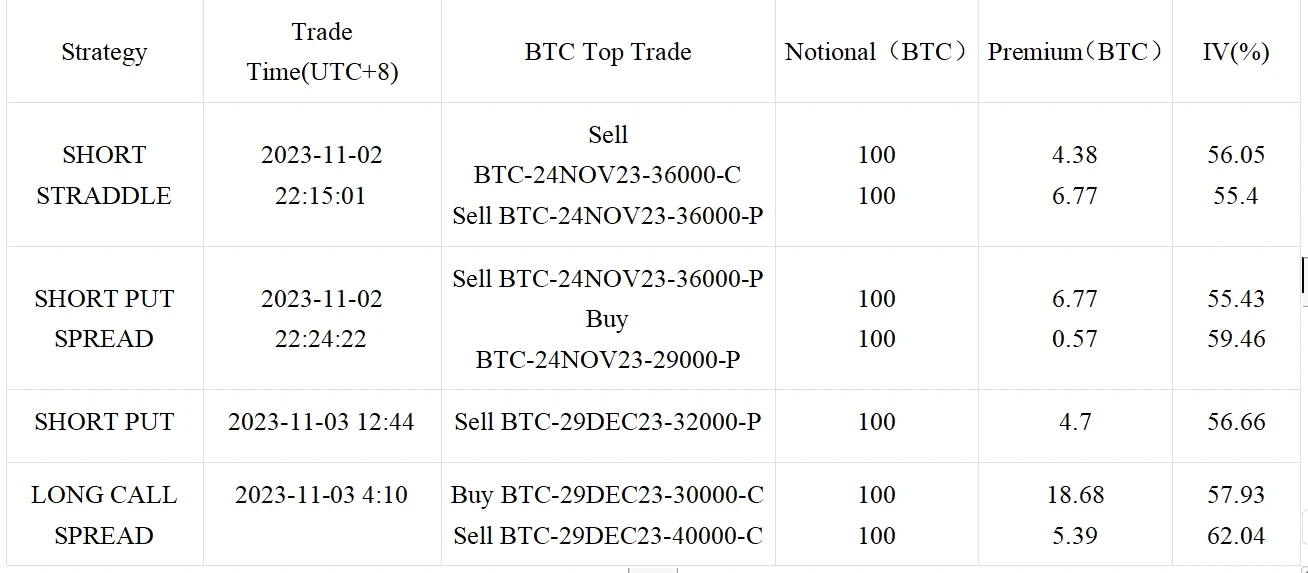

尽管无风险利率的降低推动了全球股市的走高,数字货币方面却呈现出较为消极的态势,价格出现大幅回落,BTC 再度跌至 34500 附近,回吐了昨日几乎所有涨幅。与此同时,这波价格回落也给期权市场破了一盆冷水,致使近期隐含波动率出现大幅下调,下探回到 50% Vol 附近,曲线由平走陡,大宗交易上也涌现出以 Short 24 Nov Straddle 为代表的看跌波动率策略;从 IV 曲面的斜率上看,近期 Skew 同样也随着价格出现明显下滑,目前 BTC/ETH 中前端 25 dRR 大约处在 5% /3% 左右。大宗交易方面乏善可陈,只有几笔 100 btc 大小的策略成交,市场整体交易量较前日有所下降且主要成交集中在散户/小额交易上。

Source: Binance & TradingView

Source: Deribit (截至 3 NOV 16: 00 UTC+ 8)

Source: SignalPlus

Source: SignalPlus

Source: Deribit Block Trade

Source: Deribit Block Trade

Bitcoin Price Consolidates Below Resistance, Are Dips Still Supported?

Bitcoin Price Consolidates Below Resistance, Are Dips Still Supported?

XRP, Solana, Cardano, Shiba Inu Making Up for Lost Time as Big Whale Transaction Spikes Pop Up

XRP, Solana, Cardano, Shiba Inu Making Up for Lost Time as Big Whale Transaction Spikes Pop Up

Justin Sun suspected to have purchased $160m in Ethereum

Justin Sun suspected to have purchased $160m in Ethereum